Credit union professionals should consider cautioning their members on the prevalence of fake check scams. A new update from the Federal Trade Commission shows that fake check scams led to reported individual median losses of nearly $2,000 – losses far higher than on any other of the Top 10 scams reported to the FTC. According to the new data analysis, consumers in their twenties are more than twice as likely as people 30 and older to report losing money to these scams.

The FTC’s latest Consumer Sentinel Data Spotlight, drawing on complaints submitted from consumers across the country, calls attention to the growing prevalence of fake check scams. According to the spotlight, complaints about fake check scams are up 65% since 2015.

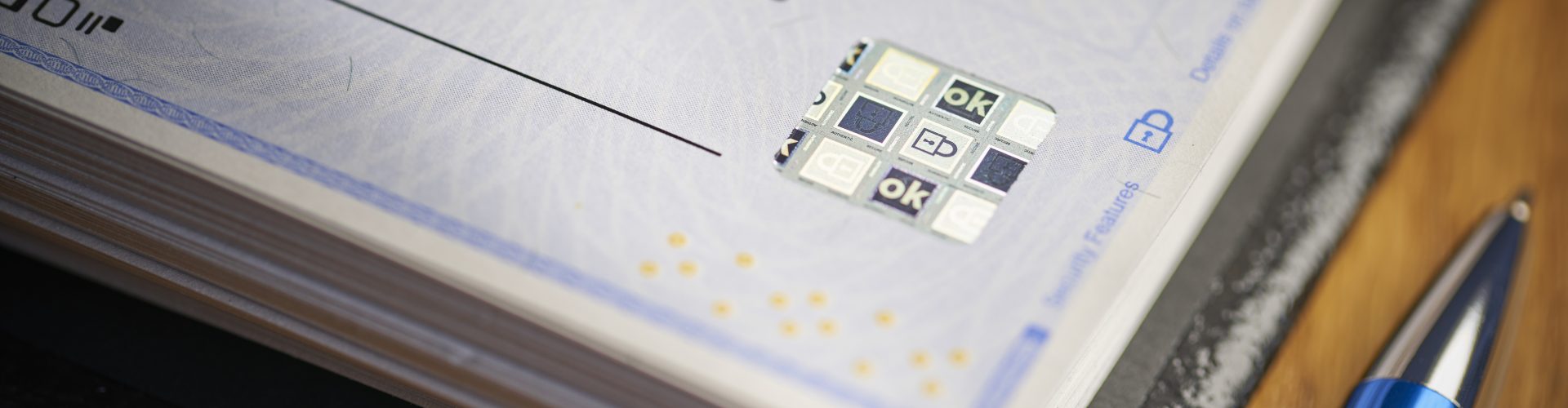

In fake check scams, consumers are contacted by a scammer, who sends them a check that looks real, with a request to send some of the money to a third party. When a consumer deposits the check, the money initially shows up in their bank account, making it seem as though the check was real. The consumer then sends the money on, as instructed by the scammer. Eventually, the consumer’s bank discovers the check was fake and removes the full amount from their account.

The FTC’s analysis showed that more than half of fake check scams involve a job offer or income opportunity of some kind, and scams involving selling items online represent nearly a fifth of the total.

The analysis also shows that consumers in their twenties are often contacted by scammers directly through their college and university email accounts with messages made to look like official school communications.

For additional details on fake check scams, visit ftc.gov/fakechecks.