Vystar Credit Union sponsors “reality fairs” at high schools through Northeast Florida to help students understand how financial decisions affect their lifestyle.

Adrian Jones is Vystar’s high school coordinator for Clay, Duval and Nassau counties. I joined him as he spent three days with students at Fleming Island High School.

Day one of the reality fair is spent in the classroom, where Jones randomly assigns each student a persona on paper. There are over 100 personas, so students each have a different situation: married or single, number of children, their profession and their monthly income. They even get assigned a credit score: good bad, or ugly — and student debt if their career required a degree. They make decisions the first day about health insurance and other prevention measures, and then they learn to calculate their take home pay, deducting taxes and benefit costs. (For the purposes of the exercise, even married personas are the sole earner, so they make all financial decisions based on their salary alone.)

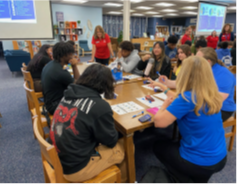

Armed with their net monthly income, day two includes a 60-minute visit to the reality fair booths carrying a clipboard and calculator. They visit the childcare booth to see how much it will cost them per child per month (at least $300.) They make a decision about renting or buying a house. They decide whether they can afford the fastest Internet service, organic food and an unlimited cell phone plan. Each buying decision goes in the debit side of their worksheet. Teacher and community volunteers help explain options and implications of buying decisions.

By the time they hit the transportation booth, some students are feeling serious adult pain.

“I have hardly any money left and rotten credit,” said one boy. “I’m buying a bike.”

Students in danger of spending more than they have can revisit booths and make more frugal buying decisions. They can also visit the charity booth and ask for some help. But the help available is based solely on what more affluent or charitable students have donated. The one option not available is to return children from whence they came; several students tried after seeing the cost of childcare.

Jones manages a booth that students can visit several times, called Life Happens. Students draw yellow cards with good or bad luck scenarios:

■ You’ve been in a car accident and have to visit the emergency room. If you bought insurance yesterday, your co-pay is $35. If not, your bill is $500.

■ Your TV dies; you have to buy a new one.

■ It’s spring and the pool needs cleaning.

■ You’ve bought a puppy; here are your vet expenses.

Sometimes it’s even good news; perhaps a neighbor offers you $200 to help him with a project. Jones presides over Life Happens with enthusiasm; he laughs delightedly or groans sympathetically with each student’s draw.

Toni Padgett, the school’s Academy Coach, said that the students take the exercise seriously. The day after the fair, she and Jones help the students discuss what they learned about work, debt, saving and spending. The lessons they carry with them will resonate for years as they make choices about careers and college, marriage, children and lifestyle. Jones advises students to try to develop good financial habits early.

It’s too bad we can’t order up a reality refresher for the rest of us every few years.

Candace Moody is vice president of communications for CareerSource Northeast Florida. Her column, Work Wanted, appears every Wednesday in the Times-Union and she can be reached at cmoody@careersourcenefl.com. Catch up on past columns, as well as local employment news and career tips, by visiting jobs.jacksonville.com.